|

|

本帖最后由 cougar 于 2025-12-9 05:06 PM 编辑

首先声明本贴非个人分析,这是AI产生的股票分析报告。文中的内容数据都在网上。

Comprehensive Stock Valuation and Perspective: Circle Internet Group (CRCL)

Date: December 6, 2025

1. Introduction and Company Overview

Circle Internet Group (CRCL) is a prominent B2B fintech platform and the primary issuer of the USD Coin (USDC), a major regulated, fully-reserved stablecoin. The company’s business model is deeply intertwined with the growth and adoption of digital currencies and the broader stablecoin ecosystem. Following its recent public listing, the stock has experienced significant volatility, prompting a detailed examination of its current valuation and future prospects. As of December 5, 2025, the stock price was $85.62.

2. Financial Performance and Key Metrics

CRCL’s financial profile is characteristic of a high-growth technology company in a nascent, rapidly expanding market. The company is currently operating at a net loss but demonstrates strong operational cash flow, a key indicator of a healthy underlying business model.

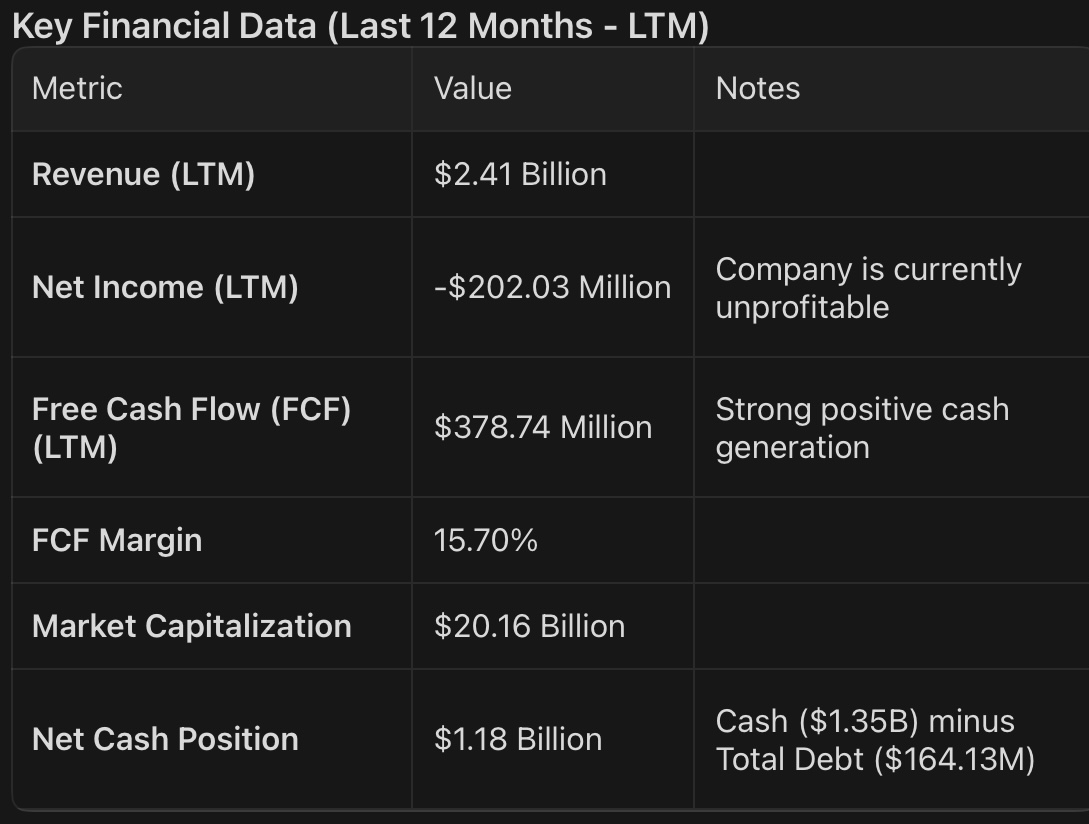

Key Financial Data (Last 12 Months - LTM)

The most notable financial characteristic is the positive Free Cash Flow despite a negative Net Income. This suggests that the net loss is primarily driven by non-cash expenses, such as stock-based compensation or depreciation, which is common for companies prioritizing growth investment. The substantial FCF of $378.74 million and a 15.70% FCF margin indicate a robust ability to generate cash from operations.

3. Valuation Analysis

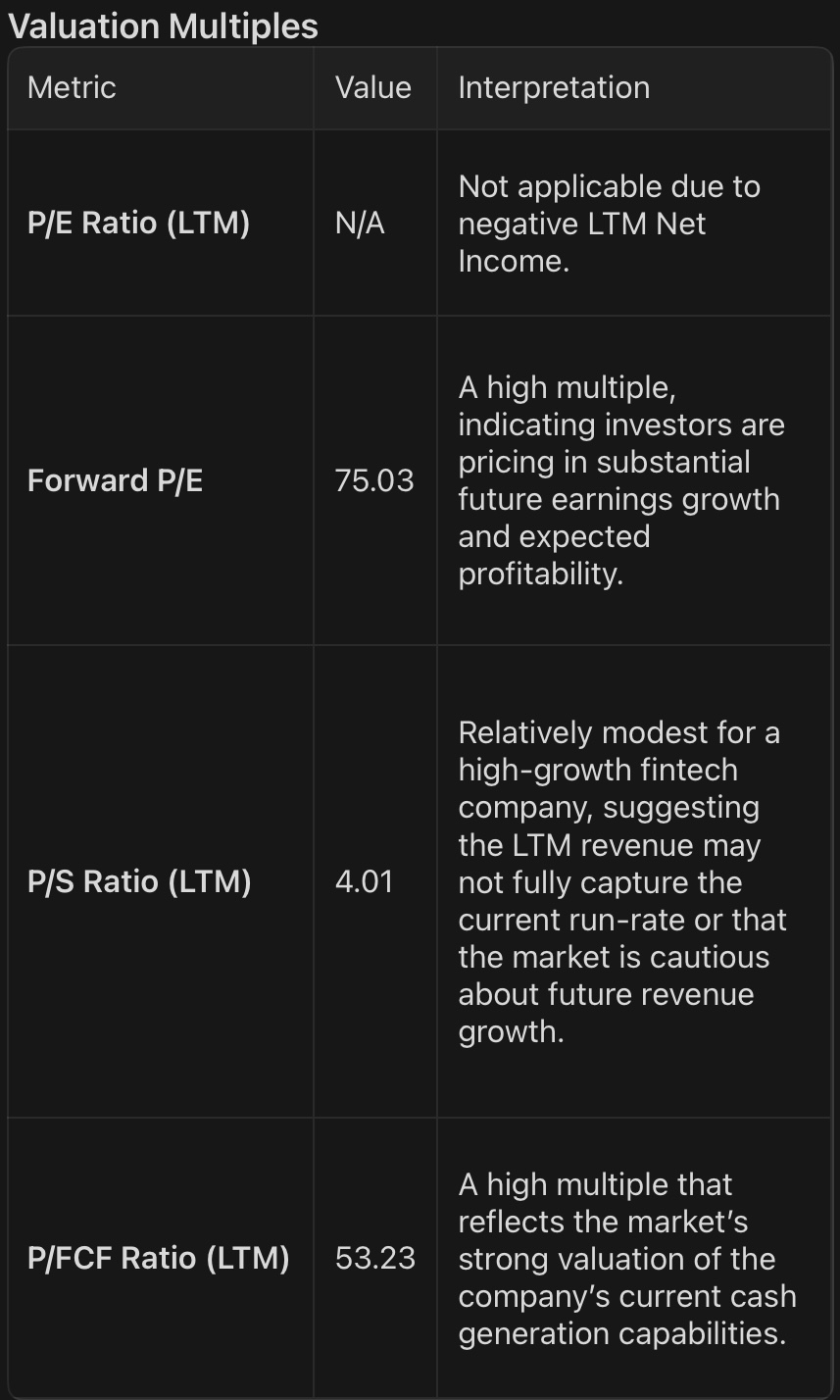

CRCL’s valuation is a complex picture, reflecting both its current financial state and the market’s high expectations for its future.

Growth-Adjusted Valuation (PEG Ratio)

The PEG Ratio (Price/Earnings to Growth) is a critical metric for growth stocks. CRCL’s PEG ratio stands at 1.09.

• 5-Year EPS Growth Forecast: 83.90%

• 5-Year Revenue Growth Forecast: 43.26%

A PEG ratio near 1.0 is generally considered to indicate a fairly valued stock relative to its expected growth rate. Despite the high Forward P/E, the massive projected 5-year EPS growth of nearly 84% suggests that the stock is reasonably priced for its anticipated trajectory in the stablecoin market. This high growth outlook is the primary justification for the current premium valuation.

4. Financial Health and Risk Assessment

Financial Strengths

The company maintains a strong balance sheet with a Net Cash position of $1.18 Billion and a very low Debt/Equity ratio of 0.05. This financial strength provides a significant buffer against market fluctuations and offers flexibility for strategic investments or acquisitions.

Key Risk Factors

1. Share Dilution: The most significant immediate risk is the high rate of share issuance, with Shares Outstanding increasing by 67.28% Year-over-Year. This substantial dilution is a major headwind for existing shareholders, as it reduces the value of each share.

2. Financial Distress Indicators: The Altman Z-Score of 0.33 (a score below 3.0 suggests an increased risk of bankruptcy) and a low Piotroski F-Score of 2 (out of 9) signal potential financial risk. While the strong net cash and positive FCF mitigate the immediate bankruptcy risk, these scores reflect the company’s current net loss and the high-risk nature of its operating environment.

5. Analyst Consensus and Outlook

The current analyst consensus on CRCL is a “Buy” rating, with an average price target of $138.64. This target implies a significant 61.93% upside from the current stock price, reinforcing the view that the market believes the company’s growth potential is not yet fully priced in.

6. Conclusion and Perspective

Circle Internet Group (CRCL) presents as a high-risk, high-reward investment opportunity.

The bullish perspective is grounded in its dominant position in the rapidly expanding stablecoin market, its strong Free Cash Flow generation, and its growth-adjusted valuation (PEG of 1.09) which suggests the stock is fairly valued for its exceptional projected growth. The strong balance sheet provides a solid foundation for future expansion.

The cautious perspective highlights the significant risk factors, particularly the extreme rate of share dilution and the low financial health scores (Altman Z-Score, Piotroski F-Score). Investors must be comfortable with the volatility and the high-growth, high-dilution nature of the stock.

Overall Perspective: CRCL is a compelling investment for investors with a high-risk tolerance and a long-term horizon who believe in the continued secular growth of the stablecoin and digital finance ecosystem. The valuation is aggressive but appears justified by the projected growth, provided the company can execute its strategy and transition to consistent Net Income profitability. |

评分

-

1

查看全部评分

-

|