|

|

楼主 |

发表于 2011-12-2 02:23 AM

|

显示全部楼层

本帖最后由 kdkboy 于 2011-12-2 03:27 编辑

The collapse of Netflix's (NFLX) stock and the seemingly endless parade of PR disasters have been well-documented. However, no one is talking about the horrible and detoriating financial situation of the company. The fact is that the numbers don't lie and the Netflix financial situation is dire. The management knows this is and is apparently willing to try anything to reverse the situation. All we need to look at is the readily-available data reported to the SEC in the latest Netflix 10-Q and K-10 reports to see the overwhelming debt facing this company and its inability to pay it off.

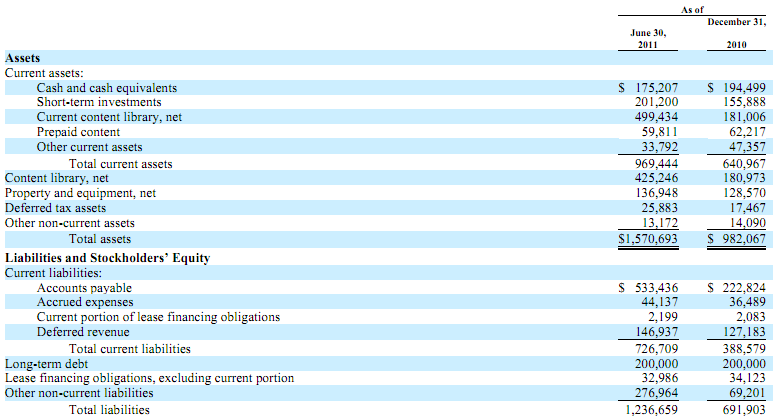

The grim picture of Netflix's financials starts with its debt. It has 2 types of debt, standard short-term and long-term liabilities on the balance sheet, as well as "Streaming Content Obligations" which reside off of the balance sheet.

Balance Sheet [click to enlarge images]

Note current liabilities of $726.7 million and accounts payable of $533.4, plus the nearly two-fold increase in total liabilities within just 2 quarters.

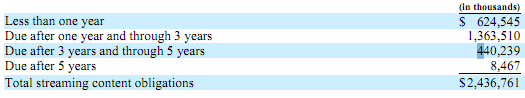

As for the off-balance sheet obligations, here they are:

So let's take a look at what Netflix owes within 1 year. It has accounts payable from the balance sheet of $533.4 plus $624.5 million off the balance sheet. That's $1.157 billion that Netflix owes within a year. Plus, there's another $1.3 billion due between 1 and 3 years. If you are a Netflix shareholder and these numbers don't scare you, the next set probably will.

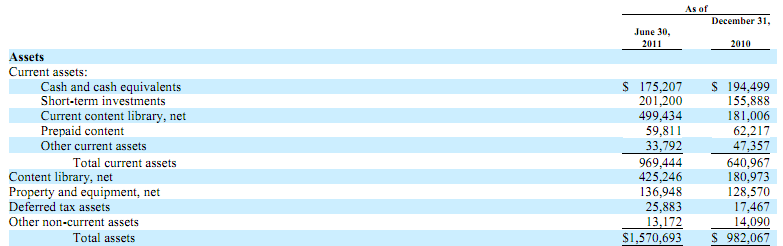

First, let's look at the current assets and cash situation to see how far that will get Netflix in paying down that debt.

Balance Sheet

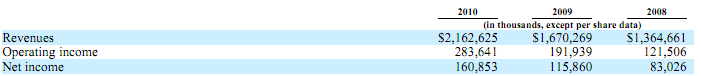

Next, we have the income statements for Year-End 2010, and YTD second quarter 2011.

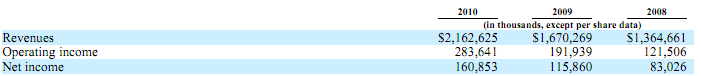

Year-end 2010

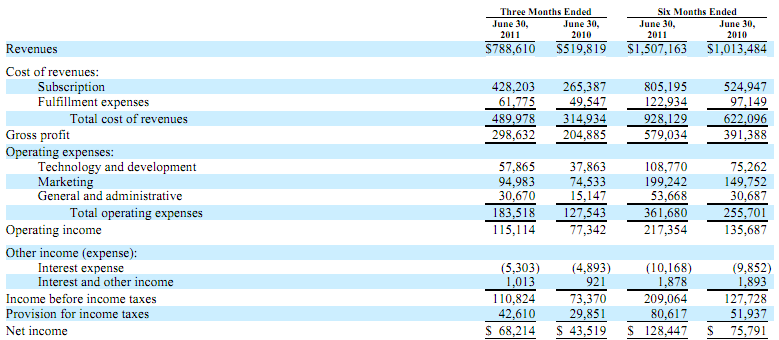

End of second quarter, YTD 2011

Netflix made $160 million in 2010, and has made $128 million so far in 2011.

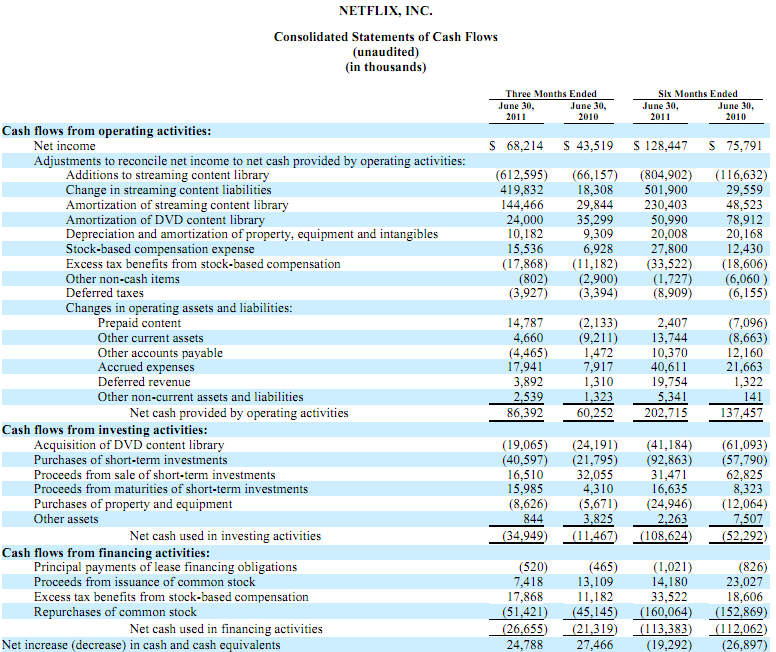

Last, there are the cash flow statements.

Cash Flow for 2010 (Consolidated Statement of Cash Flows)

(skip to the last line, net change in cash = $60 million)

2011

So to summmarize, as of 6/30/11, Netflix had $175 million in cash. Most of its other assets consist of the streaming content library that has an expiration date. They've made $128 million in net income year to date, and have generated negative cash flow YTD (-$19 million). Yet Netflix owes $1.157 billion within a year. That is a huge shortfall, and those numbers should be alarming, even for a company that is still growing, which Netflix is not. It has lost at least a million customers so far in Q3 according to its own revised guidance. Plus, content costs are only going to keep increasing as the competition grows.

How is Netflix going to make up the difference, especially while it is losing customers and the competition is rapidly increasing? There's the price increase; we'll know how much that will help in a couple weeks when it reports Q3. But considering the very vocal public backlash on not just the price increase, but also the Qwikster debacle, Netflix could easily be losing much more than 1 million customers this quarter. Plus, it's hard to imagine that CEO Reed Hastings did such a sudden reversal on Qwikster if Netflix was not seeing an alarming number of cancellations. Even if the price increase does significantly boost cash flow and net income, Netflix has a very long way to go.

Before the bulls jump in and start pointing to international growth, I'd like to remind everyone that Netflix said it doesn't expect Mexico, the country it considers to be the best Latin American opportunity, to be profitable for 2 years. Also before anyone mentions Brazil, Brazil only has 5 million broadband households with speeds fast enough to stream video, plus there are already several competitors. So international expansion is not going to make up the shortfall.

Many have speculated that the whole Qwikster fiasco was an attempt to either sell Netflix or Qwikster to raise cash. That is simply not going to happen considering the horrendous condition of the Netflix financials. It's very easy for someone like Amazon (AMZN) to go get their own content deals for their streaming service; it's been doing it for months. Furthermore, Netflix has no intellectual property, most of the content deals are non-exclusive, and the brand name has been severely tarnished. The market cap is still almost $6 billion - who is going to pay that number for this company? What would the acquirer even be buying?

The bottom line is that Netflix is in real trouble. This company has much deeper problems than just a series of PR flubs. It is nowhere close to being able to pay back their debts due within 1 year, let alone the next $1.3 billion due between 1 and 3 years. Additionally, this assumes management has not added more debt to the off-balance sheet numbers in Q3, which it probably has considering the new DreamWorks and AMC deals.

So what are Netflix's options (since Qwikster didn't work out)? None of them is very appealing, there's a secondary offering, a sale of the company at a very low price, or bankruptcy. Maybe it could do a bond issue as well, but that would be issuing long-term debt to finance short-term debt. All of these choices are horrible for shareholders.

I fully expect the price of Netflix to keep falling, and I'm staying short. Len Brecken was laughed out of the room 6 months ago for suggesting Netflix could see bankruptcy and a sub-$5 stock price by the end of 2012.

Looking at the financials, it's hard to see how that's avoided |

|