|

|

http://seekingalpha.com/article/104703-explaining-inverse-and-leveraged-etfs

Suppose you believe that the market is going to go down, what wouldyou do? The normal answer is sell what you have and get out. However,what if you have nothing to sell? Until a couple of years ago, theanswer would have been "Stay on the sidelines" for simple investors.The sophisticated investors always had plenty of avenues - shorting thestock, buying puts, selling naked calls, etc.

However, the gapwas narrowed with the arrival of Inverse ETFs that allow even noviceinvestors to short the market in a less risky way (you cannot lose morethan what you put in the ETF, while in shorts your loss istheoretically unlimited and this can be psychologically unsettling forsome). However, the power and pitfalls of these instruments are poorlyunderstood by many, particularly by the long term investors. The poweris obvious - you can go 1/X or 2/X of the market pretty easily, leavingall the pesky details of achieving them to the ETF managers. Here arethe pitfalls.

1. Inverse and Leveraged ETFs lose money over the long term

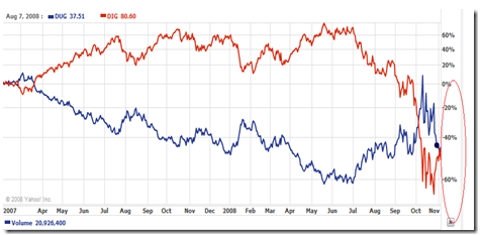

Hereis the chart from Yahoo Finance of DUG (Double inverse of petroleumcompanies) and DIG (Goes 2X in the direction of petroleum companies).Basically they are the yin and yang of Oil industry. Regardless of whathappens in the market surely one of them must win, right? But, lookdeeply at the cart - both of these funds lost 45% in the last 20 months.

So, even if you had predicted the correct direction, you would have lost half your money in just 1.5 years.

click to enlarge

2. Inverse ETFs can track the underlying for only one time period

Mathematically,leveraged and inverse ETFs can track their underlying index exactly forone time period only. If they track their index accurately for hourly,then it can't track for daily, weekly, monthly and so on. This is dueto the way compounding works. Let us say your underlying went 1% downeveryday for 1 month. The underlying will go down 26% [(1-0.01)^30],while your inverse would have gone up 35% [(1+0.01)^30]. Most inversefunds plan to track daily, so for other time periods you will see anerror.

3. Tracking error increases with time

Hereis the comparison chart between XLF (Financial Sector Index) and itsdouble Inverse SKF. SKF is supposed to go 2X in the opposite directionof XLF, and though it was good in maintaining the direction, it was notvery good in exact tracking. XLF fell 62% in the period from February2007, while SKF has gone up only 90%, instead of 124% as would havebeen expected.

4. Degenerative decay and relationship to volatility

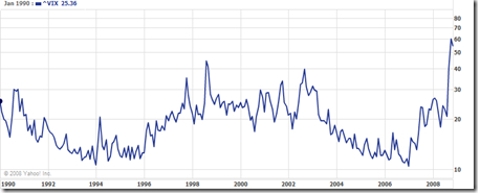

LeveragedETFs' efficiency goes down with volatility. The problem is even more sowith inverse ETFs. Let us say the Dow went from 10K to 8K and back to10K. An inverse ETF tracking accurately will go up from 100 to 120 (20%gain to equal 20% loss in Dow) and then from 120 to 90 (25% lossbecause Dow gained 25%). So, from period t1 to t2, the Dow stayed thesame, while its inverse ETF fell by 10% from 100 to 90. Repeat the sameprocess x number of times, and you will find the inverse ETFs totallywiped out of the value, while underlying has not moved much. If the Dowgoes up to 10000 from 9900 and back to 10000, the inverse would bereasonably accurate. However, we are at a historically high volatility- the highest in the last 20 years. Here is the movement of volatilityIndex [VIX] over the last 18 years.

5. Constant Leverage Trap

ConstantLeverage Trap is a well know problem in financial modeling and affectsthe performance of inverse ETFs. Here is a simple scenario explained byTyates in a financial forum:

Proshareshas $1m of investor money and borrows $1m of additional money to invest$2m in the S&P 500 index. After six months, the index appreciates10%, and then the fund has $2.2m in assets and $1.2m of equity. (Let'signore interest on debt for now).

Theproblem is that the fund now has a lower debt to equity ratio thanadvertised. It is supposed to be a 2x fund, but now only has $1m ofdebt paired with its $1.2m of equity, making it a 1.67x fund. In orderto get back to its target leverage it has to borrow $200,000 and investin the index. Now the fund has $2.4m in assets and $1.2m in debt. Sixmore months go by, and the index falls 10%. The fund now has $2.16m inassets and $1.2m in debt, leaving the investors with $960k in equity.This 4% loss surprises investors who thought that the index was down 1%for the year (+10% and -10% = -1%).

Butwhat happens next is even worse. Because the leverage ratio is out ofbalance again - total assets are 2.25x the equity, not 2x - the fundhas to sell its shares in order to reduce its leverage back down to 2x.It sells $240k worth of shares, and applies all of this cash toreducing the debt to $960k. The fund is now smaller than when itstarted. Yes, you read that correctly, to maintain constant leverage,this index fund is constantly buying and selling, incurring short-termgains, and doing the worst possible market timing - buying more onmargin when prices are high and selling when they're lower.

6. Regulatory Actions:

Whenthe SEC comes up with a short ban as it did in September, it cansubstantially screw up the market. For a couple of weeks SKF wasaffected due to its inability to find appropriate counterparties forits trade. Typically, governments tend to go more after bears thanbulls in a mistaken fear that bears are causing the problems instead ofbeing the messenger of problem information. Thus regulatory actions canbe more unfavorable to bearish strategies than bullish strategies.

http://biz.yahoo.com/ms/080919/253823.html

7. Counterparty risk

InverseETFs achieve their strategies through swaps and futures contracts withvarious counterparties. There are troubles when the counterpartiesdon't honor their contract. When these parties fail, then the ETFcould lose money.

Here is some good information on this, written by Paul Amery.

8. Other factors to consider

Canyou stomach the volatility? Double Inverse and Leverage ETFs tend tomove enormously by definition, particularly in troubled times likethese - you could see your portfolio going up or down 50 or 75% - evenif it too heavily weighted in such ETFs. Will you have trouble sleepingwell in such roller coaster activity? If so, you should not play. - HighManagement Expense - given that these ETFs are not plain vanilla - buya bunch of stock types, management expenses of maintaining leverage ispretty high. Sometimes the expense ratios can be up to 5X more thanpopular index ETFs.

Summary:

Inverseand leveraged ETFs are great tools that democratized bear strategies.However it should not be used for anything other than short termtrading purposes. And when you use it, understand its risks and don'tbe surprised when you find the results are not as promised. |

|