This analysis caught my attention, it's quite intriguing, isn't it?

tTy to draw a 5 month SPX chart to see the current situation...

It's so amazing to play numbers and probabilities with money...

-----------------------------------------------------------------------------------

Monday, April 28, 2008

Ten High Straight Up

I’ve previously discussed some of the findings in Larry Connors’ book “How Markets Really Work”. In the book Larry looks at certain market situations and determines whether the market has historically outperformed or underperformed when those situations arose. One I previously discussed was a 3-day rise in the market when it is trading under its 200-day moving average. Historically, the market has struggled to add further gains after this has occurred.

Another edge Larry discusses in his book is performance following a 10-day high. In the book he shows there has been a negative expectancy over the next 1-5 days following a 10-day high. I have personally examined 10-day closing highs and found a negative expectancy 3-5 days out when the market is under its 200-day moving average. When it is over the 200-day the expectancy is no longer negative.

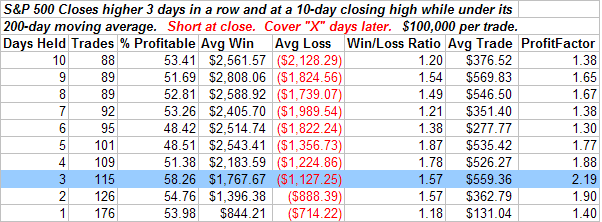

On Friday the S&P 500 closed higher for the third day in a row. It also made a 10-day high and closed at a 10-day closing high. I ran some tests to see what happened when you combined some of these 10-high criteria with 3-straight up days. Results of the different combinations I looked at were similar. Below is one example:

A negative expectancy persisted up through 12-days out. The greatest part of it appeared in the 1st three days. Of course during the next three days there is going to be a Fed announcement. The reaction to that may have a larger affect on market movement than my little test. Still, it’s worthwhile noting the negative expectancy in these situations. Below is a chart showing all the recent instances with a 3-day exit strategy.

|